Tsla decent jump this am ahead of open

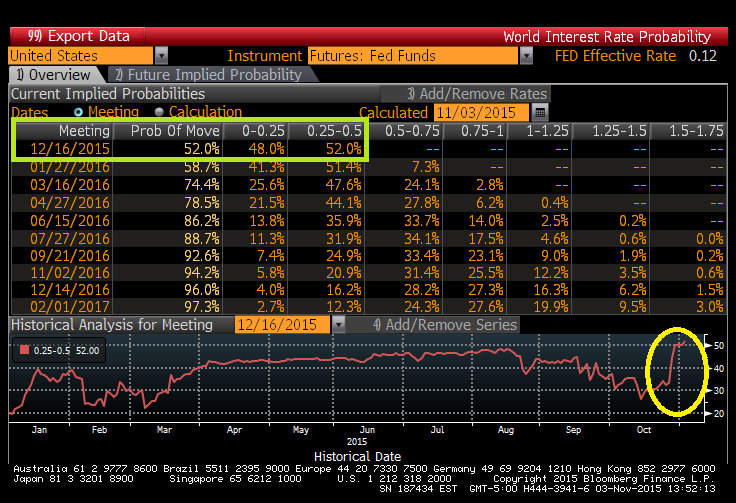

A December rate hike is a very real possibility. Bonds are extremely convex; meaning any move up in interest rates could very well crush many bond traders and create some sort of liquidity squeeze. Needless to say, this will have a spillover effect into the equity markets. I mean the broad indices are overpriced as it is either way. Personally, I don't have a problem with picking and choosing a couple of equities as long-term investments for the time being, but buying SPY e-minis or w/e it's you're doing doesn't seem like a good risk/reward play at current valuations.

Decent is the right word. Not great. I can't trade TSLA. Personally, I see this as a great chance to short again. Nobody who is short TSLA should be afraid imo.

There really was no news.

Give me the Honda NSX. Electric motors too!

Stock was behaving just as it did after hours. I got a sneak peak then.

I was in for an average of $10 and sold at $19. My contracts expire soon so the time element is against me.

Lock up the win.

Bumped into an article on Reno while I was into TSLA news. Kinda cool.

Reno Is America's Next Housing Boomtown

https://www.mainstreet.com/article/r...using-boomtown

TSLA Apple & Switch driving up real estate.

Very well thought out answer. It wouldn't surprise me if we never raise interest rates. If I had a dollar every time we were supposed to raise interest rates but didn't going back to 2010 we would have a bigger freeroll these currently do. You are not wrong about what you said.

I see a SPY chart that looks like it could break though 215 onto new highs, fundamentals be dammed.

Guess we will see. I'm one of the lucky few that sold off in 2008 and bought back in 2009 so my take is avoid the big crashes and all will be well in the end.

I am in your camp more or less Krypt. That uninterrupted rise off the lows in the SPY spelled retracement for me. Whatever. I was calling for 15,000 Dow. Didn't bet it. Just a scenario I thought was likely.

But like Daly said, you weren't gonna trade this interest rate forecast. Have a plan when they deal the flop. Then you have all kinds of action to trade. Trade what you see. Don't guess.

Daly would make a great trader. Not b/c of his success rate with props but the way he approaches risk. Translated, he knows how to gamble. He would develop a good trading strategy pretty quickly. It ain't rocket science.

Unfortunately, it sounds like he has a day job. I would love to know his routine for selecting props. I mean he can't be spending hours a day. This would be gold.

Keeping the thread on life support.

Did anyone get caught in AYA? Fuckin shit. DFS at StarsDraft is now US only. GG, revisit in the lower teens?

The FED has officially created a new normal, in my mind. After reading the FOMC minutes, it's quite clear that they never intend to end QE. Not only will they always be a reliable lender of last resort, but they will prop up the market beyond anything more dramatic than a correction > 10%.

At the beginning of this week Ive bought 1500 shares of Alcoa (AA) and bought some out of the money Cheniere (LNG) CALLS... My avg price for the Alcoa shares is 8.09

VRX and AR are two names I would look at very closely given their current valuations...

Nice hit AA. In my world, I am paying myself by banking half & free rolling the rest with loose stops. Could waste a lot of time at $10 congestion.

Been messing around with GPRO today. What a sick dog.

Chaps & I used to bash this thing when it was $50 two years ago. Twitter was another useless piece of shit.

Really happy with my AA stake. Sanlmar, I suggest looking at AVGO instead of Gpro, and Twitter has always been a POS.

When you getting out of AA?

Traded Smith & Wesson & Sturm Ruger on breakouts.

Guns have a new home on watch list

Tells ya which way the wind is blowing in 'Merica

There are currently 1 users browsing this thread. (0 members and 1 guests)