Originally Posted by

Pooh

Nice google job. You do understand ETE is king of natural gas after this deal, correct? Of course you don't because you read one little article on a company you've never heard of before and decided to post like you know what the fuck is going on. They will be the leader of natural gas exports for the US and it isn't close. Do you have any idea what they pay for natural gas where the cocks are uncut and smelly compared to what we pay here? Of course you don't. Do some more research next time you're at a rest stop and then come back and report.

THIS TRADE WILL TAKE A COUPLE YEARS TO PLAY OUT.

Thank you

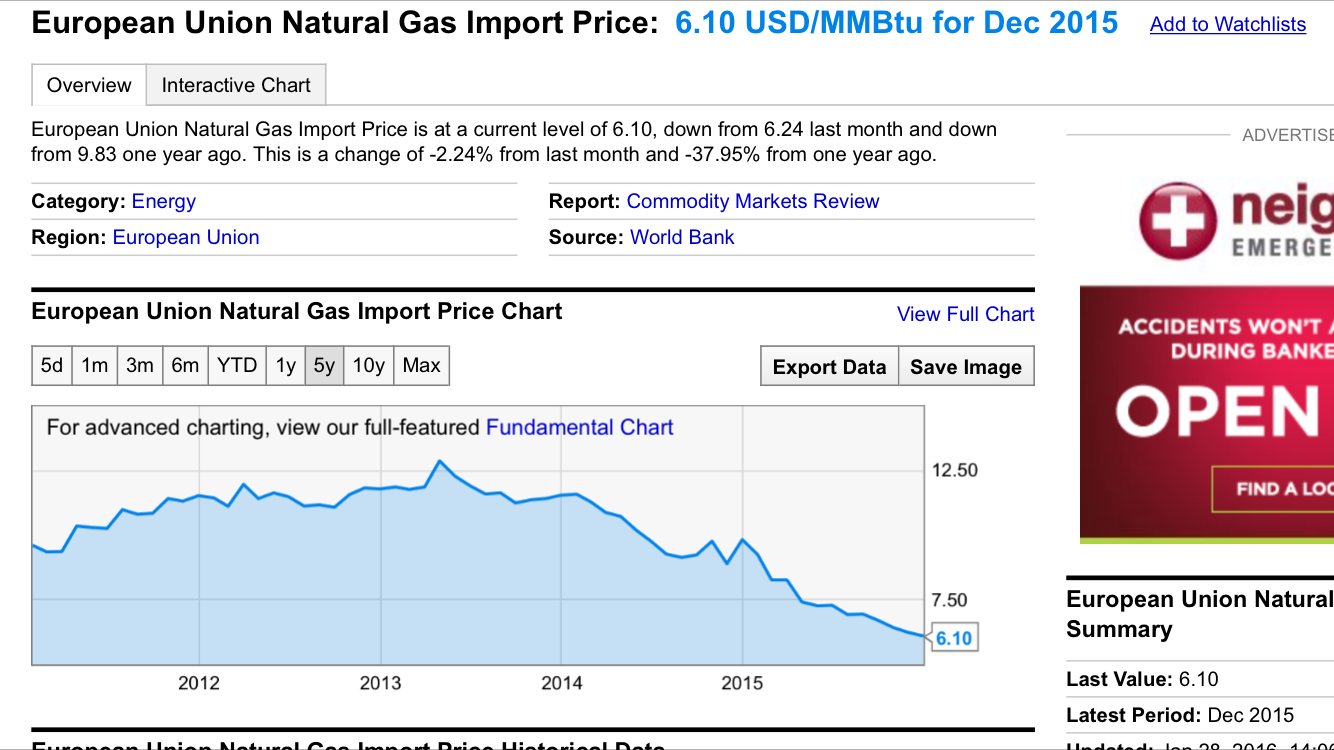

Also, I'm aware that US nat gas prices are lower than Europe's and Japan's, but I recall reading a few years ago that the cost of converting and shipping LNG is about $3-$4/MMBtu. And nat gas prices overseas have also tumbled. When it was about $12 in Europe, and about $4 in the US, the profits from exporting LNG would be great. But nearly as much now.

So will the LNG export business suffer like the shale oil plays in the 80's if world energy commodity prices persist in the doldrums for a decade? And will ETE get through that price slump without have to dilute equity?

Reply With Quote

Reply With Quote