This thread is comedy gold.

This thread is comedy gold.

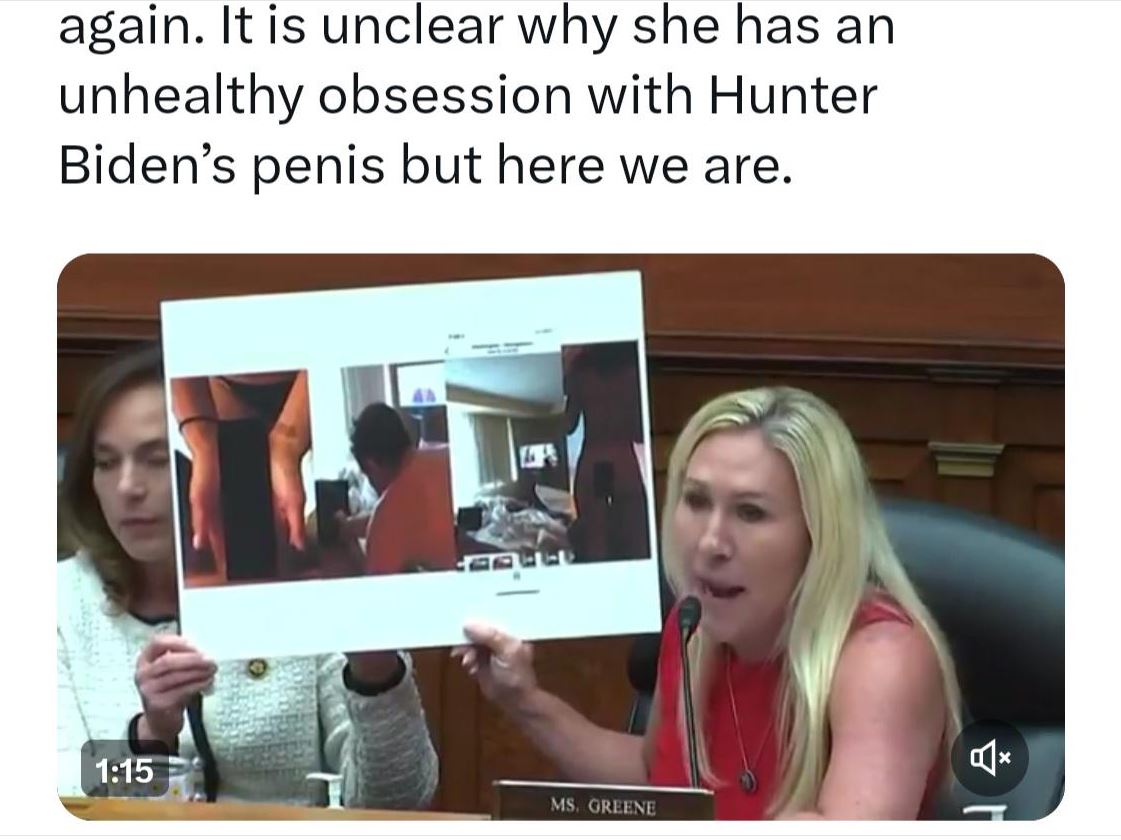

Trailer Trash Green Teeth keeping the Capitol classy. Those arms-hand belong on a man, a top-both-parts-hermy-trans-man. Any Juris Doctor want to splain the legal rationale?

trump had 44 cabinet secretaries. 40 of them don't support his 2024 campaign. Zeigt die Nüsse.

The word is she has gone against Trump now.

https://twitter.com/TammieMcDonal17/status/1937502413679669644

Congresswoman Marjorie Taylor Greene Introduces Bill to Eliminate Capital Gains Tax on Home Sales

July 10, 2025

WASHINGTON D.C. — Today, Congresswoman Marjorie Taylor Greene (GA-14) introduced the No Tax on Home Sales Act—a bold proposal to eliminate the federal capital gains tax on the sale of primary residences. This commonsense reform delivers critical tax relief to homeowners and helps increase housing supply nationwide.

“Families who work hard, build equity, and sell their homes should not be punished with massive tax bills,” said Congresswoman Greene. “The capital gains tax on home sales is an outdated, unfair burden—especially in today’s housing market, where values have skyrocketed. My bill fixes that.”

Currently, the IRS allows an exclusion of up to $250,000 ($500,000 for joint filers) in capital gains from home sales, but those limits haven’t been updated since 1997. As home prices have risen, more middle-class homeowners are being hit with capital gains taxes that were originally intended for wealthy investors.

Congresswoman Greene’s bill would:

Eliminate the federal capital gains tax on home sales

Encourage mobility by removing a key disincentive to selling, helping to increase housing supply

Deliver tax relief to homeowners looking to downsize or relocate without being penalized for appreciation

Protect first-time buyers by improving inventory and lowering prices in the most constrained housing markets

“Homeowners who have lived in their homes for decades, especially seniors in places where values have surged, shouldn’t be forced to stay put because of an IRS penalty. My bill unlocks that equity, helps fix the housing shortage, and supports long-term financial security for American families,” Greene added.

The bill explicitly applies to individuals selling their primary residence and does not apply to home flippers or real estate investors.

Congresswoman Greene continues to lead on policies that strengthen American families, protect their financial futures, and restore fairness to the tax code.

https://greene.house.gov/news/docume...ocumentID=1125

Last edited by desertrunner; 07-10-2025 at 12:28 PM.

Sharing only, no real opinion...

Late Monday, Rep. Marjorie Taylor Greene (R-GA) posted on X a demand for action on the expiring Affordable Care Act subsidies, one of Democrats’ key arguments in government funding negotiations.

The tax credits help people who buy insurance through the Affordable Care Act marketplaces cover the premiums, which are expected to more than double next year if the tax credits expire. Republicans have said they will not negotiate on the issue until Democrats vote for their bill to reopen the government.

Greene said she’s “not a fan” of the ACA but said she’s “absolutely disgusted” about the premium increase.

“I’m going to go against everyone on this issue because when the tax credits expire this year my own adult children’s insurance premiums for 2026 are going to DOUBLE, along with all the wonderful families and hard-working people in my district,” she said.

There are currently 1 users browsing this thread. (0 members and 1 guests)